Yesterday's meltdown seems menacing but it is not uncommon market behavior during bottoming activity. Everything pointing to an important low is still there. For example here are two measures of breadth for the last few days:

- new 52 week highs - lows:

source: Stockcharts.com

- XLY vs. XLP ratio:

source: Stockcharts.com

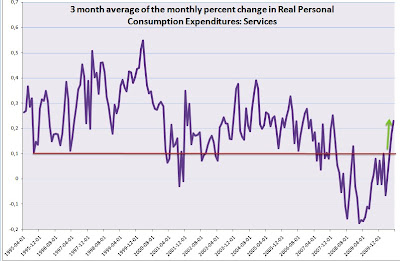

On the economic front, yesterday's personal consumption report was not a weak one. The strength in services consumption is becoming more evident even if it may have reached the height of its normal interval of variation:

In conclusion, even if the market is close to a make-or-break situation (if it does not rally today more weakness will probably follow), I still think an important low is forming at these levels. This is why I will try not to be the yo-yo at the end of the market's string (Carl Futia's coinage) and cover on marginal new lows immediately after the open.

No comments:

Post a Comment