What drives the price of gold? Inflation and inflation expectations would respond most people interested. In fact, some are obsessed by more than inflation - hyperinflation is just around the corner and it is going to make the price of gold shoot through the roof! They cannot explain why gold has risen despite the rather deflationary environment since 2008, but they have made money and that's all that matters.

But there is another view, which is not known to many. Gold is priced just like bonds are. That means that gold is sensitive to the expected fluctuations of the real interest rate. Here are some blog post by Paul Krugman explaining this:

http://krugman.blogs.nytimes.com/2011/09/06/treasuries-tips-and-gold-wonkish/?smid=pl-share

http://krugman.blogs.nytimes.com/2011/09/10/golden-spikes/?smid=pl-share

http://krugman.blogs.nytimes.com/2012/08/26/golden-instability/?smid=pl-share

In short, what this means for gold now is that it should rise whenever the economy is expected to slowdown, because this would imply a lower real interest rate as long as the Fed keeps inflation expectations relatively high.

As I said in my previous post, a slowdown in the economy, and mostly in employment, can be anticipated starting in January. If retail sales continue lower, the direction will be confirmed. Meanwhile, Gold has come to a very nice, low-risk buy point - committing below its 200 DMA and hitting monthly support.

I think this point will represent the low for the multi-month correction in gold and that a move to new highs will start soon. Generally, gold is ending its corrections as the market approaches a bigger correction. With yesterday's developments regarding the fiscal negotiations, a more important top for the stock market may have been pulled closer.

Friday, December 21, 2012

Monday, December 17, 2012

December 17, 2012 - target 1522

The market seems to have tipped its hand since I last wrote. It has strengthened up after reaching intermediate term oversold levels, as shown in my previous post.

Here is a monthly chart of the SPX.

The bull market has a tendency to correct at long term resistance levels. The next one to the upside is 1522.

A move to this level would also represent a break out of a rising wedge - not uncommon for this chart pattern.

The economic picture has some points of weakness, but consumption, as a consequence of a continuing recovery in employment, is doing ok.

But this is a symptom of an ending recovery. Businesses have expanded their profits first, then they added equipment & software and then they started adding more workers, which led to higher consumption. Now, they are cutting back on investment and they will soon slow down on hiring. Here is a chart showing the correlation between capital expenditures and employment. Capex leads employment.

So, during the first half of 2013, employment reports will most probably get worse and worse. The market will ignore this for a while, since this means the Fed will stay easy, but the Wile E. Coyote moment will come, just in time for the upside break out of the wedge to fail, as it many times does.

Here is a monthly chart of the SPX.

The bull market has a tendency to correct at long term resistance levels. The next one to the upside is 1522.

A move to this level would also represent a break out of a rising wedge - not uncommon for this chart pattern.

The economic picture has some points of weakness, but consumption, as a consequence of a continuing recovery in employment, is doing ok.

But this is a symptom of an ending recovery. Businesses have expanded their profits first, then they added equipment & software and then they started adding more workers, which led to higher consumption. Now, they are cutting back on investment and they will soon slow down on hiring. Here is a chart showing the correlation between capital expenditures and employment. Capex leads employment.

So, during the first half of 2013, employment reports will most probably get worse and worse. The market will ignore this for a while, since this means the Fed will stay easy, but the Wile E. Coyote moment will come, just in time for the upside break out of the wedge to fail, as it many times does.

Thursday, November 15, 2012

November 15, 2012 - on the edge, again

The drop below 1400 on the ES only resulted in a small bounce. Conservative longs averted the subsequent crash however, because the market did not really come to the buyers. Whoever chased it, got punished on November the 7th and afterwards. Patience is indeed the key to successful trading.

Now the market has reached the 1350 level, which I think will support at least another bounce. Here is a daily chart of the SPX.

The market tends to bounce after it breaks important levels. It did so after settling below the 200 DMA and I think it will do it again after closing below SPX 1354. If the market bounced a bit without clearly committing below 1354, then it would just be ready to break lower.

Certainly, the market is oversold from a bull market perspective. Using the chart below the average momentum of different moves can be evaluated.

Any lower than this for this correction and the market is entering bear mood again! It has been quite a whipsaw during the last 2-3 years from this point of view, but this means something too. The unprecedented volatility from bull to bear suggests we are at a big inflection point.

So, the question is whether this will be just a bounce in a larger drop or a continuation of the long term uptrend. My gut goes with the first, my system with the second. The market has nothing positive to anticipate fundamentally but it is oversold in a larger uptrend. I guess if this is the start of a bear, we will first get a bigger bounce into the end of the year.

P.S. - As I have written this post the market started falling again. If it does not reverse until the close, tomorrow will be a good opportunity to go long on weakness below 1340

Now the market has reached the 1350 level, which I think will support at least another bounce. Here is a daily chart of the SPX.

The market tends to bounce after it breaks important levels. It did so after settling below the 200 DMA and I think it will do it again after closing below SPX 1354. If the market bounced a bit without clearly committing below 1354, then it would just be ready to break lower.

Certainly, the market is oversold from a bull market perspective. Using the chart below the average momentum of different moves can be evaluated.

Any lower than this for this correction and the market is entering bear mood again! It has been quite a whipsaw during the last 2-3 years from this point of view, but this means something too. The unprecedented volatility from bull to bear suggests we are at a big inflection point.

So, the question is whether this will be just a bounce in a larger drop or a continuation of the long term uptrend. My gut goes with the first, my system with the second. The market has nothing positive to anticipate fundamentally but it is oversold in a larger uptrend. I guess if this is the start of a bear, we will first get a bigger bounce into the end of the year.

P.S. - As I have written this post the market started falling again. If it does not reverse until the close, tomorrow will be a good opportunity to go long on weakness below 1340

Wednesday, October 24, 2012

October 24, 2012 - time to go long

Update: October 25, 1:35 pm - I did not buy the break below 1400 and I am sitting on the sidelines at least until tomorrow. The intraday reading on the cpc is at the overbought level while the market is falling - this usually is a setup for continuation to the downside.

The bull has paused a bit after the good news in September (economy expanding, the Fed easing further). The market usually does so as the news becomes undeniably good.

This being said though, I think the market has reached the point from where it should start rising again. The set up looks pretty good: there are many who are calling for a longer drop from here, the market looks committed to the downside, the futures contract has reached strong monthly support, indicators are oversold and the economy still looks strong

Here is a daily chart for the SPX, showing commitment below 1425

and a monthly chart of the December contract, showing important support at 1404 being reached

There is also a buy signal from the 13 day ema of TRIN, which has become oversold yesterday:

This market setup is coming in the context of a still strong economy, one that does not yet show signs of going into recession. Here is a chart of the pace of change in real retail sales, showing a still strong rhythm of growth.

The series has a bit more to grow before a slowdown in economic activity can be anticipated.

Now I have to admit that this bullish scenario is supported mostly by technicals (breadth, market behavior, support levels, sentiment etc.). The fundamentals that lie ahead are not very encouraging: the fiscal cliff and decreasing earnings.The market has chosen to ignore these until now. Will it do so in the future too? Who knows?

Anyway, the technical setup will lead to at least a bounce from here, so the risk is very low. A drop below 1400 on the December contract is a good point to buy. This may happen as the Fed makes its announcement today.

The bull has paused a bit after the good news in September (economy expanding, the Fed easing further). The market usually does so as the news becomes undeniably good.

This being said though, I think the market has reached the point from where it should start rising again. The set up looks pretty good: there are many who are calling for a longer drop from here, the market looks committed to the downside, the futures contract has reached strong monthly support, indicators are oversold and the economy still looks strong

Here is a daily chart for the SPX, showing commitment below 1425

and a monthly chart of the December contract, showing important support at 1404 being reached

There is also a buy signal from the 13 day ema of TRIN, which has become oversold yesterday:

This market setup is coming in the context of a still strong economy, one that does not yet show signs of going into recession. Here is a chart of the pace of change in real retail sales, showing a still strong rhythm of growth.

The series has a bit more to grow before a slowdown in economic activity can be anticipated.

Now I have to admit that this bullish scenario is supported mostly by technicals (breadth, market behavior, support levels, sentiment etc.). The fundamentals that lie ahead are not very encouraging: the fiscal cliff and decreasing earnings.The market has chosen to ignore these until now. Will it do so in the future too? Who knows?

Anyway, the technical setup will lead to at least a bounce from here, so the risk is very low. A drop below 1400 on the December contract is a good point to buy. This may happen as the Fed makes its announcement today.

Friday, September 14, 2012

September 14, 2012 - the bear is dead!

For the third time this bull is rising from the grave to haunt short sellers. It first happened in 2010 and then in 2011. Bernanke's black magic (read: QE) is on the job again in 2012.

Leaving jokes aside, this is good news. Nobody, except childish permabears like Tim Knight at The Slope of Hope, craved a bear market and a recession in the current context of the global economy. It could easily have morphed into a depression with grave consequences. The sad truth, I believe, is that this depression has only been postponed.

Here is one indicator that made me ditch the bear market scenario- 52 week New Highs - Lows:

It has reached record levels for this bull. There are also other indicators that are stronger than they should be during a bear market rally.

The spike in NYHL is a sign of strength, but also a sign of exhaustion for the short term. As it happened in November 2010 after the announcement of QE2, I think the market will correct for a few days. A drop in the 1420-1430 area would represent a nice opportunity to go long.

Supporting a coming correction is the fact that the SPX settled above the important 1440 resistance and then reached the 1460 level. Usually, the market pulls back after reaching such important levels.

The intermediate term leg should be fine though. The market is up only about 16%. A 20% move would bring it to 1522 - the next important level on the upside.

Here is a monthly chart of the SPX showing these levels.

Leaving jokes aside, this is good news. Nobody, except childish permabears like Tim Knight at The Slope of Hope, craved a bear market and a recession in the current context of the global economy. It could easily have morphed into a depression with grave consequences. The sad truth, I believe, is that this depression has only been postponed.

Here is one indicator that made me ditch the bear market scenario- 52 week New Highs - Lows:

It has reached record levels for this bull. There are also other indicators that are stronger than they should be during a bear market rally.

The spike in NYHL is a sign of strength, but also a sign of exhaustion for the short term. As it happened in November 2010 after the announcement of QE2, I think the market will correct for a few days. A drop in the 1420-1430 area would represent a nice opportunity to go long.

Supporting a coming correction is the fact that the SPX settled above the important 1440 resistance and then reached the 1460 level. Usually, the market pulls back after reaching such important levels.

The intermediate term leg should be fine though. The market is up only about 16%. A 20% move would bring it to 1522 - the next important level on the upside.

Here is a monthly chart of the SPX showing these levels.

Friday, September 7, 2012

September 07, 2012 - still a bear rally

The surge to new highs yesterday looks very bullish but by my measures this rally is not strong enough to pull the market out of the bear market condition..

Here are some indicators.

> percent of SPX stocks above their 50 DMAs - this indicator helped correctly decide that the bear market thesis was not valid anymore back in October 2011. Now, the indicator is below the 80-85 bull/bear threshold.

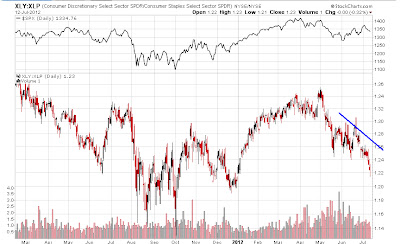

> XLY vs XLP (discretionary vs staples) - huge underperformance

> the monthly ratio of cumulative advancing vs declining volume - it will have to pass the upper horizontal line to enter bull market territory.

> average momentum - the same as above

Meanwhile, the SPX is just below the important monthly resistance at 1440.

I think a top will develop as the market settles above this level, probably next week or the week after, following a short term pullback that starts today (the market has already committed to new highs - see my previous post).

Tuesday, August 21, 2012

August 21, 2012 - the concept of commitment

Generally, as the SPX commits beyond an important level, an inflection point is created. Here is how this principle has worked lately.

By commitment I understand a close or a strong move far enough beyond a certain level.

This concept of commitment is nothing else than the general contrarian approach so indispensable to any trader, applied for the short term. If detecting the crowd commitment over the long term is easier, doing it over the short term is a bit challenging. The method illustrated above is an answer to this challenge and it provides an interesting way of looking at market action.

By commitment I understand a close or a strong move far enough beyond a certain level.

This concept of commitment is nothing else than the general contrarian approach so indispensable to any trader, applied for the short term. If detecting the crowd commitment over the long term is easier, doing it over the short term is a bit challenging. The method illustrated above is an answer to this challenge and it provides an interesting way of looking at market action.

Monday, August 13, 2012

August 13, 2012 - the top is close

Even though I am not posting as often as in the past, I will try to do it at least every time something significant for the intermediate term takes place.

The intermediate term bear market rally I have been talking about has approached the previous SPX highs. This was somewhat expected given the anticipated bounce in the economy after the spring - summer slowdown.

The rhythm of the rally seems to be changing. I do not think we will see steep 1-3 days sell offs anymore. Here is a monthly SPX chart with important resistance levels drawn.

The eventual top will take place as the market becomes overbought and breaks through one of these levels. A break to new highs took place as the market topped out in October 2007. It might happen this time too.

As to being overbought for the intermediate term, there are a few indicators that are close or even already there. This tells me that a top is close by, probably in the first week of September.

Here is the 5 day ema of the put/call ratio. it reaches the red horizontal line as a bear market rally gets overbought. It can stay there for a short while before the market turns lower.

Here is the average rate of change indicator. It reaches the purple horizontal line as bear market rallies top out. This indicator going significantly above the line is usually a first sign that the bear has morphed into a bull.

As these indicators signal a top and as the market comes above the significant levels I talked above, I will make an investment on the short side. Since this should be a long term turning point, I will keep this investment and add to it as future opportunities (read: bear market rallies) present themselves.

As for a target expectation for this future bear, it is hard to say. The 2009 lows are not out of the question as things could get really ugly. Even lower is also a possible scenario.

However, for the long term, it is better to target a process, a context and not an outcome. But I will elaborate on the different scenarios in a future post.

The intermediate term bear market rally I have been talking about has approached the previous SPX highs. This was somewhat expected given the anticipated bounce in the economy after the spring - summer slowdown.

The rhythm of the rally seems to be changing. I do not think we will see steep 1-3 days sell offs anymore. Here is a monthly SPX chart with important resistance levels drawn.

The eventual top will take place as the market becomes overbought and breaks through one of these levels. A break to new highs took place as the market topped out in October 2007. It might happen this time too.

As to being overbought for the intermediate term, there are a few indicators that are close or even already there. This tells me that a top is close by, probably in the first week of September.

Here is the 5 day ema of the put/call ratio. it reaches the red horizontal line as a bear market rally gets overbought. It can stay there for a short while before the market turns lower.

Here is the average rate of change indicator. It reaches the purple horizontal line as bear market rallies top out. This indicator going significantly above the line is usually a first sign that the bear has morphed into a bull.

As these indicators signal a top and as the market comes above the significant levels I talked above, I will make an investment on the short side. Since this should be a long term turning point, I will keep this investment and add to it as future opportunities (read: bear market rallies) present themselves.

As for a target expectation for this future bear, it is hard to say. The 2009 lows are not out of the question as things could get really ugly. Even lower is also a possible scenario.

However, for the long term, it is better to target a process, a context and not an outcome. But I will elaborate on the different scenarios in a future post.

Thursday, July 19, 2012

July 19, 2012 - after the slowdown comes the acceleration

I started talking about a slowdown in the economy during spring this year. Judging by some indicators I watch, this slowdown has come to fruition.

Here is the pace of change in Real Retail Sales,

and the CPI.

The stock market usually anticipates and accompanies these indicators as they move lower. This time was no different.

Simce the indicators reached the lower boundaries of their intervals of variation, the next move will be up. This would mean some good news for the economy until the autumn, but I do expect this bounce to be weak. Anyway, it will push the stock market higher and help lure in some imprudent bulls.

Friday, July 13, 2012

Update (July 13, 2012) - a contrarian sign

The latest cover from The Economist is not a good sign. Here it is.

And here is the cover from June 2007. Somewhat similar.

And here is the cover from June 2007. Somewhat similar.

Everybody knows what happened afterwards.

This contrarian sign just brings more confirmation to the bear-market thesis. In the same vein, the rally off the 1250 lows is looking weak. Here is a ratio of two etfs: consumer discretionary items and consumer staples (XLY vs. XLP).

The underperformance is obvious. It usually is this obvious at important turning points.

Will the rally continue? I think so, given that intermediate term indicators are not yet overbought. I believe a higher low was made yesterday.

The 5 day ema of the put/call ratio will probably reach the overbought level for bear markets first before the market tops out. Just in time to turn most of the participants bullish. In fact, one can always count on the majority's incredible ability to become overoptimistic at important tops.

Saturday, June 30, 2012

Update (June 30, 2012 - still a bear market rally

Impressive rally on Friday but breadth was weak compared to the way prices advanced.

First, it was not a 90% up volume day. This is a clear sign of weakness given the huge gap up and the rise into the close.

Second, short term TRIN (a 3 day ema of TRIN) is underperforming and did not even reach the overbought level.

This weakness as the market rallies is not something that happened during the bull comebacks of 2010 and 2011, so this is still a bear rally.

Even if I think the market will head higher over the intermediate term, probably as the economy bounces a little, it is important to classify this rise as a bear rally as it will eventually offer a great opportunity to sell.

First, it was not a 90% up volume day. This is a clear sign of weakness given the huge gap up and the rise into the close.

Second, short term TRIN (a 3 day ema of TRIN) is underperforming and did not even reach the overbought level.

This weakness as the market rallies is not something that happened during the bull comebacks of 2010 and 2011, so this is still a bear rally.

Even if I think the market will head higher over the intermediate term, probably as the economy bounces a little, it is important to classify this rise as a bear rally as it will eventually offer a great opportunity to sell.

Friday, June 22, 2012

Update (June 22, 2012)

The way the market sold off yesterday is the mark of bear market rallies.

Up to here, the bull has not been revived as in 2010 or 2011.

Looking at other intermediate term bear market rallies, there are two possibilities from here:

1. a resumption of the uptrend after a little consolidation, similar to August 2007.

2. some range trading and maybe a retest of the 1250 lows, similar to February-March 2008

It can only be a guess which scenario would play out. There is compelling evidence for both of them. I will only point out that, in the past, scenario number 1 has mostly been the rule, while scenario number 2 has been the exception.

Friday, June 15, 2012

Update (June 15, 2012)

The growth rate for retail sales is decelerating towards the lower boundary but it is just half-way through.

The market rallies many times advance of the turn in the series but it has to reach closer to the "oversold" level.

Meanwhile, the market fell after gaping up on Monday but it never really came to the sellers, so I expect to see another dive next week, maybe even before the Fed meeting.

I think that a break above 1342 (September contract) is a nice point to sell for a drop to 1300.

This would be a trade taken against the 1332.75 resistance on the monthly chart (monthly levels are usually broken by 10-15 points before the market reverses).

Thursday, June 7, 2012

Bear-market rally

The market is bouncing off monthly support. Although it did not look set for a bounce at the bottom, yesterday's rally strongly invalidates the possibility of another fall to new lows over the short term.

Since, by my measures, this is a bear-market, I am calling this a bear-market rally. These rallies can go on for a few months and pull back more than everyone expects - in the autumn of 2007 the market made new highs on the first bear-market rally.

The way up is punctuated however by strong sell-offs. I looked at previous cases and the first such sell-off will most probably come after a break above the important level highlighted by blue segment below.

This, especially as the behavior of the total put/call ratio suggests there still are many stubborn shorts that got caught wrong footed and have not bailed out yet. The ratio has spiked towards oversold yesterday despite the huge rally (the scale is inverted below).

Since, by my measures, this is a bear-market, I am calling this a bear-market rally. These rallies can go on for a few months and pull back more than everyone expects - in the autumn of 2007 the market made new highs on the first bear-market rally.

The way up is punctuated however by strong sell-offs. I looked at previous cases and the first such sell-off will most probably come after a break above the important level highlighted by blue segment below.

This, especially as the behavior of the total put/call ratio suggests there still are many stubborn shorts that got caught wrong footed and have not bailed out yet. The ratio has spiked towards oversold yesterday despite the huge rally (the scale is inverted below).

Friday, June 1, 2012

What's next

Probably some short term "bounce" in economic activity. Here is a leading indicator:

But, first, a drop in retail sales pace of change too.

Thursday, May 31, 2012

Saved by the revision

After the first estimate of the Q1 GDP I posted this chart, noting that the series has made a first downtick and that a second one would signal a recession.

Below I updated the chart after today's release. The downtick is gone!

The headline number for the just released revision may be weak but there are some improvements under the hood.

Wednesday, May 30, 2012

Update

The market has been bouncing lately off strong monthly SPX cash support at 1292.

However, it rarely makes a lasting turn at an important level without at least a minor break. The ES monthly chart for the June contract suggests the market may reach 1270 before a turn.

Also, there is important data coming in on Friday: ISM Manufacturing PMI and Nonfarm Payrolls.

As I mentioned in the past, the economy is slowing down (at least over the short term), so I expect the data to be weaker than expected.

The PMI may have put in a lower high last month ...

... and the private payrolls number is decelerating already.

However, it rarely makes a lasting turn at an important level without at least a minor break. The ES monthly chart for the June contract suggests the market may reach 1270 before a turn.

As I mentioned in the past, the economy is slowing down (at least over the short term), so I expect the data to be weaker than expected.

The PMI may have put in a lower high last month ...

... and the private payrolls number is decelerating already.

Tuesday, May 22, 2012

Analogy

I highlighted in the chart below action from 2007 after long multiday drops and a rise similar to yesterday. We could see a retest of the lows in the following days, followed by more upside.

Friday, May 18, 2012

The bear is back

Two of the indicators I am watching have reached levels specific only to bear markets.

Here they are:

> a ratio of the monthly cumulative advancing versus declining volume.

> the 5 day ema of the total put/call ratio (this is not as reliable as the first one but the fact that it comes after important divergence with the bull gives it legitimacy).

This is the third time since 2010 this happens, which says enough about the unprecedented volatility of the market. I remember George Soros writing in The Alchemy of Finance that abnormal volatility usually portends an important turn, so what has been happening until now is not a good sign.

What to do about it?

Change the strategy of buying intermediate term corrections to selling intermediate term bounces (a first bounce can reach even the highs at 1420). Also, go long for the short term as the market becomes oversold.

Meanwhile, watch for signs of strength that would indicate a possible come back of the bull as it happened in the autumn of 2010 and of 2011.

Here they are:

> a ratio of the monthly cumulative advancing versus declining volume.

> the 5 day ema of the total put/call ratio (this is not as reliable as the first one but the fact that it comes after important divergence with the bull gives it legitimacy).

This is the third time since 2010 this happens, which says enough about the unprecedented volatility of the market. I remember George Soros writing in The Alchemy of Finance that abnormal volatility usually portends an important turn, so what has been happening until now is not a good sign.

What to do about it?

Change the strategy of buying intermediate term corrections to selling intermediate term bounces (a first bounce can reach even the highs at 1420). Also, go long for the short term as the market becomes oversold.

Meanwhile, watch for signs of strength that would indicate a possible come back of the bull as it happened in the autumn of 2010 and of 2011.

Tuesday, May 15, 2012

The middle of the correction

The market has gotten oversold after the 6% drop from the top. Here is an indicator that reaches the lower horizontal line at intermediate term bottoms.

This is an average between two longer term rate of change measures. When reaching the oversold line after a correction a new bull move up usually follows.

However, the indicator can dip below the oversold line before another bull leg starts. It did so during the January 2010 intermediate term correction just before a 2 day rally that only represented a bounce.

Now, the market looks the same and I think a bounce will again only be temporary.

Here is Jan-Feb 2010:

and here is May 2012:

A bounce from here would take place, as is usually the case, after a clear break of an important level. here is a monthly chart of the June contract.

This is an average between two longer term rate of change measures. When reaching the oversold line after a correction a new bull move up usually follows.

However, the indicator can dip below the oversold line before another bull leg starts. It did so during the January 2010 intermediate term correction just before a 2 day rally that only represented a bounce.

Now, the market looks the same and I think a bounce will again only be temporary.

Here is Jan-Feb 2010:

and here is May 2012:

A bounce from here would take place, as is usually the case, after a clear break of an important level. here is a monthly chart of the June contract.

Subscribe to:

Posts (Atom)