And here is the cover from June 2007. Somewhat similar.

Everybody knows what happened afterwards.

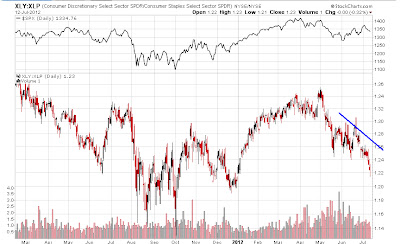

This contrarian sign just brings more confirmation to the bear-market thesis. In the same vein, the rally off the 1250 lows is looking weak. Here is a ratio of two etfs: consumer discretionary items and consumer staples (XLY vs. XLP).

The underperformance is obvious. It usually is this obvious at important turning points.

Will the rally continue? I think so, given that intermediate term indicators are not yet overbought. I believe a higher low was made yesterday.

The 5 day ema of the put/call ratio will probably reach the overbought level for bear markets first before the market tops out. Just in time to turn most of the participants bullish. In fact, one can always count on the majority's incredible ability to become overoptimistic at important tops.

1 comment:

Thanks for the update!

Yup, no mistake, I think we are in bear market.

Tony

Post a Comment