The GDP number was bad but the bigger than expected slowdown is mainly due to a big negative contribution for motor vehicles and parts - consequence of the Japan earthquake - and a negative contribution from the consumption of gasoline and other energy goods. Both are temporary events, but they can influence the economy. We will see how the bounce behaves this autumn!

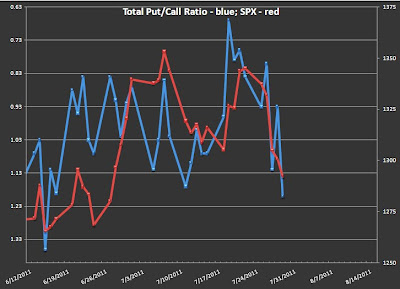

Meanwhile, the market can be shorted with no risk of major surprises from the political front, since the debt ceiling debate is close to being left behind. The bad expectations for the NFP number will probably drag the market down after the initial rally on the debt ceiling news. I will start looking for a short tomorrow. For now, the market is oversold over the short term and ready to bounce. In order to sell, I would like to see first a spike up on my cpc chart and the ES around the 1313 resistance.

I think the market will trade down until Friday after a short bounce and then head up again into the FOMC next week. I also expect a bigger rally this autumn on the back of improving economic data. The quality of this rally will give me info as to whether the bull has ended or not.

No comments:

Post a Comment