I think the market is close to another bull leg up above 1400 SPX. The economy has been slowing down after accelerating at the end of 2010 and this puts some economic indicators at the lower bound of their intervals of variation. Also, the stock market has been correcting since May and is now oversold, especially when looking at sentiment. This correction has been benign until now, meaning that a bull market top has not been registered yet.

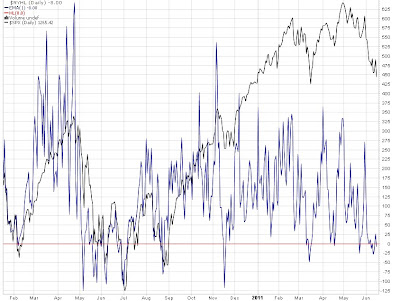

Indeed, yesterday's retail sales report puts the average monthly pace of change in real retail sales between the horizontal green lines from where it has turned in the past:

Also, the latest report on China PMI suggests economic strength from here, as the series is at levels that represented inflection points in the past:

These are just two but the most important of some indicators I watch. I will present others as the data comes in, especially at the end of the month for capital expenditures and personal consumption of durable goods. Meanwhile, I will also note that the latest inflation data suggests the deflation peril was avoided and that core inflation is rising towards more benign levels for a deleveraging economy.

This economic context finds the stock market near the 200 DMA and oversold. The correction was not too damaging until now with breadth still not reaching bearish levels, as suggests the New 52 Week Highs-Lows Indicator.

If the economy starts to accelerate in the second half of the year, this suggests a buy points is not too far. In the chart above I marked two important support levels. Also, when the 200 DMA is so close, usually, the market breaks it and stays for a few days below it before a significant advance so I expect the bottom to develop somewhere around 1230 SPX. It is important to remember that this bottoming process can last for a few weeks or more.

Looking closer, over the short term I expect a bottom today and a move up until the Fed meeting next week, followed by a decline to 1230-35 SPX. The market looks ready for such a bounce because the put/call ratio has spiked a lot yesterday. Also there was not an hourly close to new lows after lunch time yesterday and the last hour of trading was not very weak for the first time after many sessions.

1 comment:

Adi, thanks for the update!

Tony

Post a Comment