Tuesday, August 31, 2010

Update

Cut My Long Position in Half at 1044.75 ES

Market Outlook

Monday, August 30, 2010

Market Outlook for Monday

Sunday, August 29, 2010

The 10 Point Mistake

On Friday I added to my long position before the 10 am report. Big mistake!

One of my most favored entries is fading the 10 am news report when the market is oversold or overbought. In the current case the market was oversold and I wanted to go long. The reversals after 10 am news are especially powerful when the news would confirm the trend that is about to reverse. Indeed on Friday the lower consumer sentiment number would have been consistent with more downside had the market not been ripe for a turnaround.

Still, this time I completely forgot about the 10 am report. As the market touched the 1050 support it seems I just entered a trance and skipped the upcoming Ben Bernanke speech or the Consumer Sentiment report. Had I not done that, I would have probably been able to add at 1040 ES. This means that my omission cost me 10 ES points. Two or three more of these and they sum up to a full standard loss.

Friday, August 27, 2010

A Glance at the GDP Revision

Looking in the Rear-view Mirror

Thursday, August 26, 2010

Ready to Go Long

Wednesday, August 25, 2010

Market Outlook

Trade Idea: Buy Oil

Tuesday, August 24, 2010

Downside Target

Monday, August 23, 2010

The Bullish Case: More Evidence

Friday, August 20, 2010

Long Half the Standard Size at 1069.25

Update

Contrarian Signal

Analogies

Thursday, August 19, 2010

Out of 50% of the Longs at 1078.25

Market Outlook: Rally Time!

It seems that as the market moved higher, approaching 1100, the bears were confident enough to add to shorts. It does not get any better than this for the bulls. It is time to add to longs.

It seems that as the market moved higher, approaching 1100, the bears were confident enough to add to shorts. It does not get any better than this for the bulls. It is time to add to longs.

Wednesday, August 18, 2010

Market Outlook

Tuesday, August 17, 2010

Lines in the Sand

Monday, August 16, 2010

Added to Longs at 1068 ES

Trade Update

Saturday, August 14, 2010

The Retail Sales Conundrum

Friday, August 13, 2010

Trade Plan

Scenarios

I am using SPY charts because the intraday behavior is more evident.

Here is nowadays:

March-May 08:

The red box highlights the period most similar to what the market has been doing from the beginning of August 2010. There is an initial rally on the 1st of April, a period of distribution and then a correction with a big gap down and continuation on April the 11th (August the 11th nowadays). I circled in green the day where we are now. This analogy portends a rally to higher highs from these levels.

July-September 08:

Again there is an initial rally, a consolidation, a correction and a day after the big move down that would be yesterday’s correspondent (circled in green). A move up follows but no higher highs.

So, which one will it be this time? Is the market going to make higher highs?

Here’s an update on one of the indicators I introduced before. Note that it has reached the overbought level for bear markets (green circle) and it has fallen sharply. In the previous bear market after this kind of a fall the rally never made it to higher highs.

Thursday, August 12, 2010

Update

Getting Ready to Go Long

US Consumers Still Depressed

Wednesday, August 11, 2010

Wild Market

Tuesday, August 10, 2010

Quick Update

Expectations on Fed Behaviour: QE 2.0

Monday, August 9, 2010

Quick Market Update

Sunday, August 8, 2010

Trade Idea: Short US T-Notes

Friday, August 6, 2010

Quick Update

Looking for Strength into the FOMC Meeting

Thursday, August 5, 2010

Market Outlook

Wednesday, August 4, 2010

Out at 1119 ES

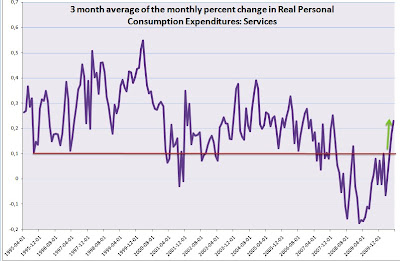

The Limping Foot: Services

The series in the chart above is the 3 month moving average of the monthly percent change in Real Personal Expenditures on Services (click to enlarge).

The series in the chart above is the 3 month moving average of the monthly percent change in Real Personal Expenditures on Services (click to enlarge).