There are also all sorts of divergences with other indicators like the 52 week New Highs - Lows or the percentage of stock above their 50 day moving averages.

Taken separately, these would not mean much but when the market is at big resistance and it is selling off like it did yesterday chances are we are at an intermediate tern top.

A good way to take trading decisions is to look for evidence that would invalidate a certain scenario.

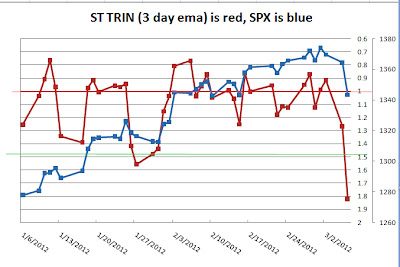

Until now, the IT top scenario was strongly invalidated by a strong TRIN. This is not the case anymore and I have to dismiss my initial expectation of a move to 1450 SPX.